Will The US Presidential Elections Impact Investment Markets

Table of Contents

Every four years, global attention turns to the United States—not just for the political outcome, but for the effect it has on the economy. The US Presidential Elections impact markets in ways that ripple across the world, influencing stocks, currencies, commodities, and investor sentiment.

While the upcoming US presidential race between incumbent Joe Biden and his likely challenger Donald Trump could potentially have some short-term impact on US markets, historical data indicates there’s next-to-no difference between average returns in presidential election years and average returns in non-election years.

Why US Elections Matter to Markets

The United States is the world’s largest economy, and its policies influence global trade, investment flows, and market confidence. During an election year, When US Presidential Elections Impact Markets uncertainty often fuels market volatility as investors try to anticipate the potential policies of each candidate.

Key areas that markets react

- Tax policy – corporate and individual tax rates directly affect earnings.

- Regulation – energy, banking, and technology sectors are especially sensitive to policy shifts.

- Trade policy – tariffs and international agreements impact global supply chains.

- Government spending – infrastructure, defense, and social programs affect economic growth.

Global Ripple Effects

The US Presidential Elections Impact Markets beyond Wall Street. International investors carefully watch outcomes, as changes in US policies can influence:

- The Australian dollar (AUD) and other currencies.

- Commodity prices like oil and gold.

- International stock exchanges, including the ASX.

Short-Term Fluctuations vs. Long-Term Strategy

For Australian investors, shifts in US interest rate policy or trade strategy can have a direct effect on superannuation funds and local business performance.

Which is to say… there’s no material benefit to basing your investment strategies on who might be presiding over the White House come this time next year.

When US Presidential Elections Impact Markets that’s despite the fact that ASX trends tend to mirror what’s happening in American markets.

What markets dislike—and this is as true in Australia as it is in the United States—is uncertainty.

That means there’s likely to be a period of short-term fluctuation as investors speculate around what effects a Democratic or Republican victory may have, before the market begins to settle back into more familiar patterns.

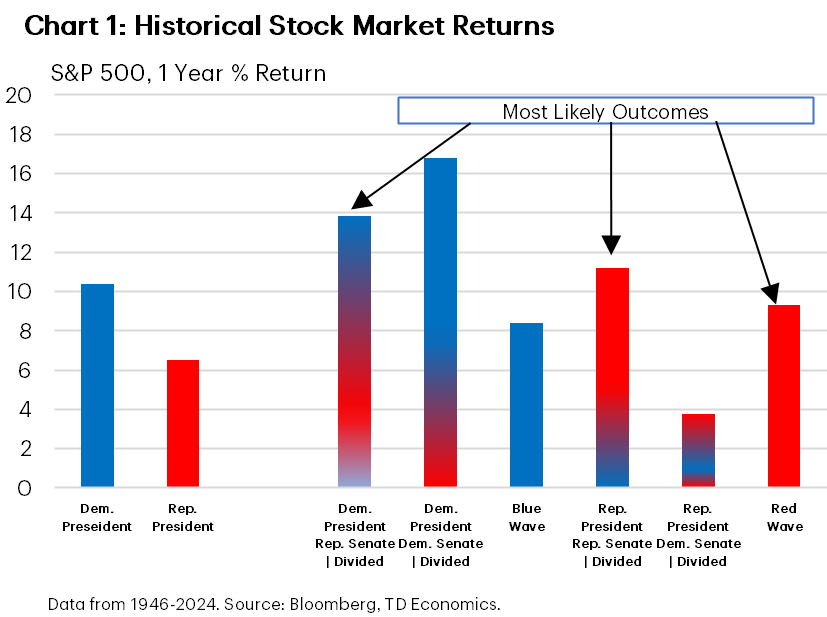

What may play a role is a Democratic or Republican sweep—where one party effectively controls the entire US government and holds the power to enact sweeping legislative changes.

With early polls suggesting Biden and Trump are the two candidates most likely to contest the presidential election in November, both parties are likely to garner their fair share of support.

Which means there’s no real reason to rush out and hedge your bets on one candidate or another. The smarter strategy is simply to play the long game and not be swayed by any short-term volatility.

Much as events like US presidential elections can cause fluctuations in the market, things like interest rates and inflation closer to home play a far more significant role in whether the ASX trends up or down.

When US Presidential Elections Impact Markets So don’t read too much into what’s going on in Washington, D.C.

Need Expert Advice on Where to Invest?

If you’re concerned about stock market volatility we can help.

Our team of experienced financial advisors know all about how to build wealth—whether it’s in the short-term or by playing the long game.

Worried about the potential effects of the US presidential elections on your share portfolio?

Drop us a line or give us a call on +61 02 9415 1511 to discuss.